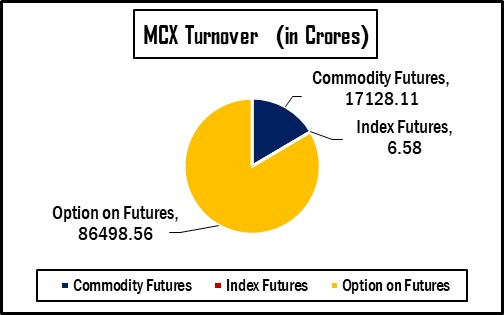

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs. 103633.25 crores in various futures & option contracts for commodities listed at MCX on Thursday, April 24, 2025 till 4:30 pm. In which commodity futures accounted for Rs. 17128.11 crores and options on commodity futures for Rs. 86498.56 crores (notional). Bullion Index MCXBULLDEX May-25 futures was reached at 22136.

Commodity Future Contracts:

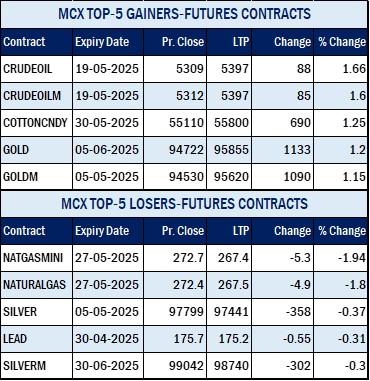

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 14547.00 crores. At the time of writing, MCX GOLD futures, with June-2025 expiry contract was up by Rs. 1133 or 1.2% to Rs. 95855 per 10 gram, GOLDTEN April-2025 contract was up by Rs. 800 or 0.84% to Rs. 95700 per 10 gram, GOLDGUINEA April-2025 contract was up by Rs. 423 or 0.56% to Rs. 76546 per 8 gram and GOLDPETAL April-2025 contract was up by Rs. 74 or 0.77% to Rs. 9647 per gram. On other hand, GOLDM May-2025 contract was up by Rs. 1090 or 1.15% to Rs. 95620 per 10 gram.

SILVER futures, with May expiry contract was down by Rs. 356 or 0.36% to Rs. 97443 per kg, while SILVERM April-2025 contract was down by Rs. 314 or 0.32% to Rs. 97280 per kg and SILVERMIC April-2025 contract was down by Rs. 155 or 0.16% to Rs. 97246 per kg.

GOLD futures clocked turnover of Rs. 7169.90 crores with volume of 7474 lots and OI of 20716 lots while SILVER futures clocked turnover of Rs. 2123.38 crores with volume of 7226 lots and OI of 18997 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1603.15 crores. COPPER April-2025 contract was up by Rs. 1.1 or 0.13% to Rs. 853.95 per kg and ZINC April-2025 contract was up by Rs. 1.4 or 0.56% to Rs. 252.15 per kg while ALUMINIUM April-2025 contract was down by Rs. 0.7 or 0.3% to Rs. 233.8 per kg and LEAD April-2025 contract was down by Rs. 0.55 or 0.31% to Rs. 175.15 per kg.

COPPER futures clocked turnover of Rs. 858.61 crores, ALUMINIUM futures Rs. 274.75 crores, LEAD futures Rs. 24.59 crores, and ZINC futures clocked turnover of Rs. 305.89 crores.

Energy: Turnover of energy futures products contributed for Rs. 1092.54 crores. CRUDEOIL May-2025 contract was up by Rs. 88 or 1.66% to Rs. 5397 per BBL while NATURALGAS April-2025 contract was down by Rs. 5 or 1.93% to Rs. 254.5 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 357.89 crores and NATURAL GAS futures Rs. 559.55 crores.

AGRI: MENTHAOIL April-2025 contract was down by Rs. 2.6 or 0.29% to Rs. 909 per kg and COTTONCNDY May-2025 contract was up by Rs. 690 or 1.25% to Rs. 55800 per candy.

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 86498.56 crores turnover (notional), having premium turnover of Rs. 926.86 crores.

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option May contract at Strike price of Rs. 5400 was up by Rs. 37.7 or 21.38% to Rs. 214.00 with volume of 33767 lots & OI of 13319 lots, while CRUDE OIL Put Option May-2025 contract at Strike price of Rs. 5300 was down by Rs. 43 or 19.61% to Rs. 176.3 with volume of 29654 lots & OI of 7284 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option May contract at Strike price of Rs. 280 was down by Rs. 2.35 or 13.47% to Rs. 15.10 with volume of 5807 lots & OI of 3956 lots, while NATURAL GAS Put Option May-2025 contract at Strike price of Rs. 260 was up by Rs. 2.15 or 14.33% to Rs. 17.15 with volume of 5432 lots & OI of 3025 lots.

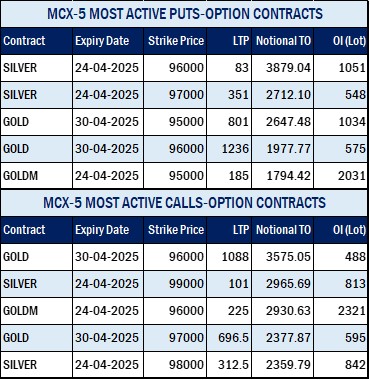

GOLD Options: Most traded contracts among GOLD Options were Call Option April-2025 contract at Strike price of Rs. 96000 was up by Rs. 473 or 77.6% to Rs. 1082.5 with volume of 3698 lots & OI of 488 lots, while GOLD Put Option April-2025 contract at Strike price of Rs. 95000 was down by Rs. 464 or 36.94% to Rs. 792 with volume of 2787 lots & OI of 1039 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option April contract at Strike price of Rs. 99000 was down by Rs. 211.5 or 67.68% to Rs. 101 with volume of 10143 lots & OI of 812 lots, while SILVER Put Option April-2025 contract at Strike price of Rs. 96000 was down by Rs. 36.5 or 31.6% to Rs. 79 with volume of 13578 lots & OI of 1056 lots.