Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.12,85,062.24 crores in various futures & option contracts for commodities listed at MCX during the week of February 21 to 27. Bullion Index MCXBULLDEX Mar-25 futures was reached at 20264.

It is worth mentioning here that at the end of the week on Thursday, 27 February, an all-time high turnover (notional) of Rs. 1,71,025 crore was recorded in GOLD (1 kg) options contracts on MCX. Along with this, the highest volume of 200 metric tonnes was seen in it. Earlier during the week, on Monday, 24 February, a record turnover (notional) of Rs. 51,149 crore was recorded in GOLD-MINI options contracts. This shows that the interest of traders in options is increasing.

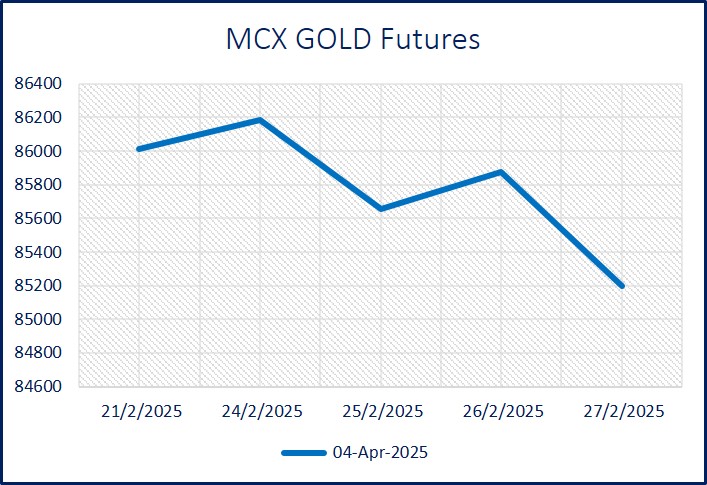

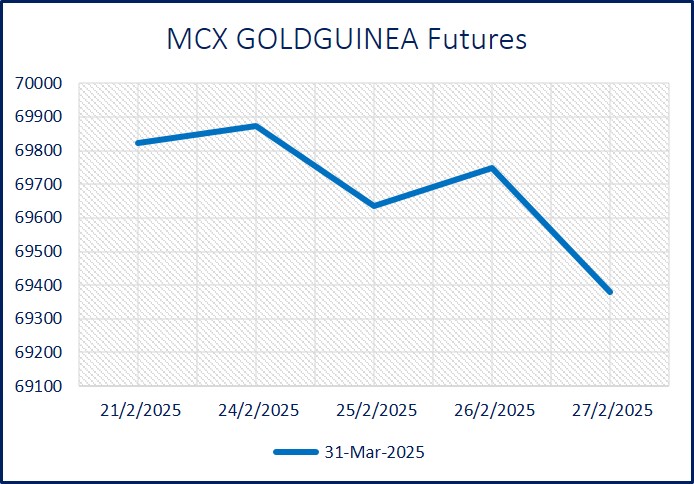

During the week, a total turnover of Rs. 1,01,733.62 crore was traded in 8,65,503 trades in GOLD and SILVER precious metals futures on MCX. In GOLD contracts, MCX GOLD April futures opened the week at Rs.85,715 per 10 gram and touched an intra-day high of Rs.86,576 and a low of Rs.84,879 during the week and closed the week down by Rs.828 at Rs.85,196. Against this, GOLD-GUINEA March contract fell by Rs.623 to Rs.69,381 per 8 gram and GOLD-PETAL March contract fell by Rs.48 to Rs.8,689 per 1 gram. GOLD-MINI March futures opened at Rs.85,630 per 10 gram and fell by Rs.707 to Rs.85,123.

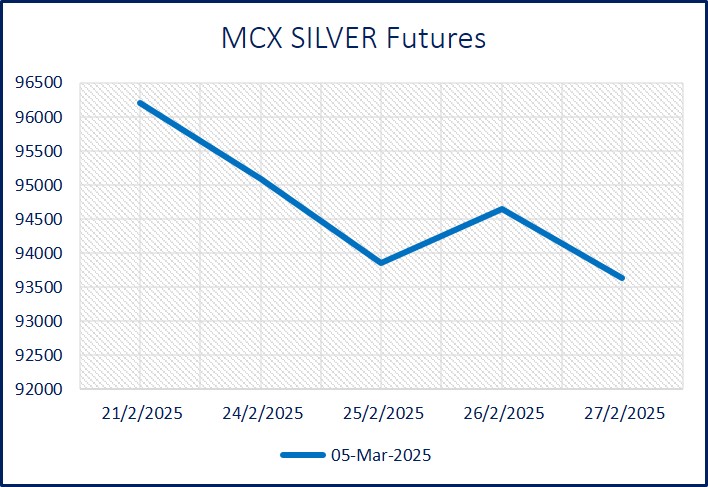

In SILVER futures, SILVER March futures opened the week at Rs.96,802 per 1 kg, touched an intra-day high of Rs.97,079 and a low of Rs.93,075 during the week and closed the week at Rs.93,635, down by Rs.3478. SILVER-MINI April contract fell by Rs.3211 to Rs.95,608 and SILVER-MICRO April contract fell by Rs.3,197 to close at Rs.95,612.

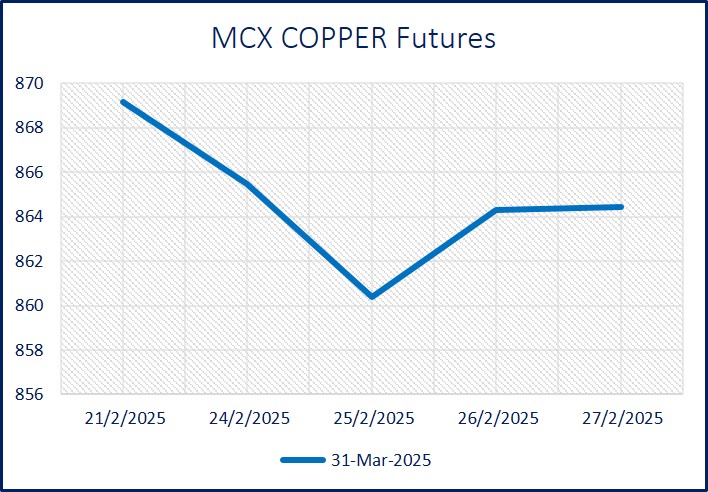

In metals futures, MCX witnessed a turnover of Rs.12,694.15 crore in 91,572 trades. ALUMINIUM March futures fell by Rs.4.15 to Rs.258.75 per 1 kg and ZINC March futures fell by Rs.5.35 to Rs.268. In comparison, COPPER March contract fell by Rs.9.35 to Rs.864.45 and LEAD March contract fell by Rs.0.90 to Rs.181.

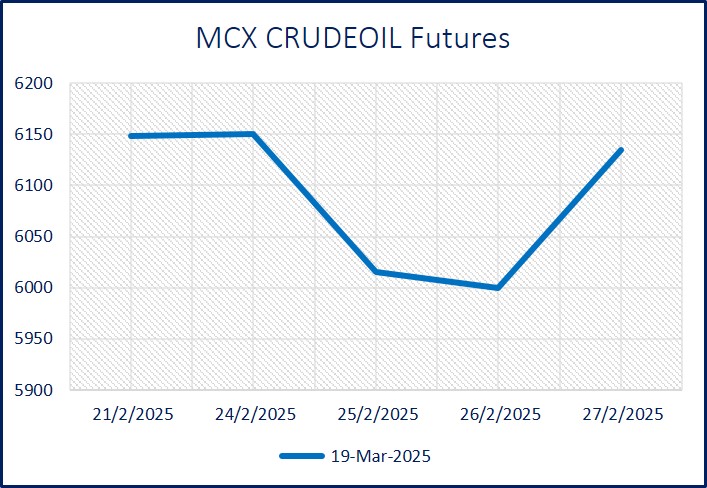

In the energy segment, futures worth Rs.33,166.12 crore were traded in 7,51,946 trades on MCX. CRUDE OIL March futures opened the week at Rs.6,279, touched intra-day high of Rs.6,299 and low of Rs.5,976 during the week, and at the end of the week slipped by Rs.181 to Rs.6,135 per barrel, while NATURAL GAS March futures closed at Rs.347.70 per 1 MMBTU, down by Rs.1.50.

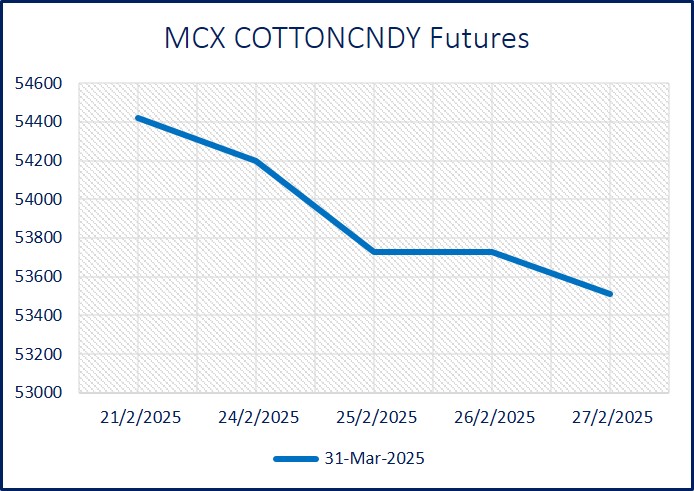

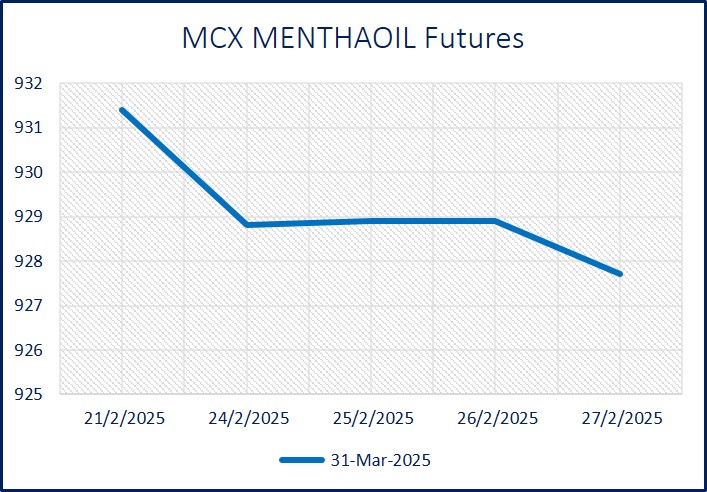

In agricultural commodities, MCX witnessed a turnover of Rs.12.44 crore in 306 trades. COTTON CANDY March futures opened at Rs.54,200 per candy, touched a high of Rs.54,200 and a low of Rs.53,510 during the week intra-day, and closed the week at Rs.53,510, down by Rs.910. MENTHA OIL futures March contract declined by Rs.7.00 to Rs.927.70 per kg.

In terms of trading, among precious metals on MCX, GOLD futures traded 67,175.282 kg worth Rs.57,647.72 crore in 2,56,439 trades and SILVER futures traded 4,582.084 tonnes worth Rs.44,085.90 crore in 6,09,064 trades. In the Energy segment, CRUDE OIL futures traded 66,21,900 barrels worth Rs.4,050.55 crore in 47,854 trades, and NATURAL GAS futures traded 68,44,66,250 MMBTU worth Rs.24,356 crore in 3,38,970 trades. In Agricultural Commodities, COTTON CANDY futures traded 144 candies worth Rs.0.19 crore in 3 trades, and MENTHA OIL contracts traded 132.48 tonnes worth Rs.12.25 crore in 303 trades.

Open Interest at the end of the week stood at 19,841.275 kg in GOLD Futures and 987.941 tonnes in SILVER Futures, 4,02,800 barrels in CRUDE OIL and 2,41,23,750 MMBTU in NATURAL GAS and 12,192 candies in COTTON CANDY, 112.320 tonnes in MENTHA OIL on MCX.

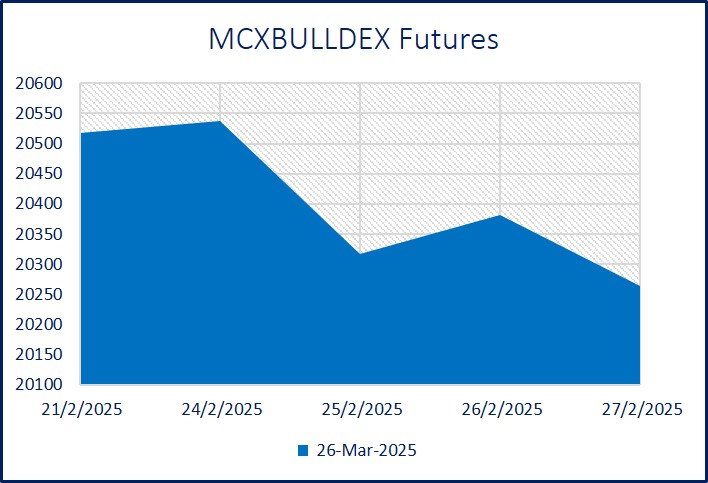

In Index Futures, 333 lots worth Rs.34.15 crore were traded in 299 trades in Bulldex Futures during the week on MCX. Open Interest in Bulldex Futures at the end of the week stood at 64 lots. Bulldex March futures opened at 20,502 and after a movement of 430 points, fell by 478 points to close at 20,264.

In options, Options on Futures recorded a notional turnover of Rs.11,37,421.76 crore in 66,55,957 trades on MCX. Call and put options of GOLD were traded for Rs.5,33,891.24 crore, call and put options of SILVER and SILVER-MINI were traded for Rs.74,702.98 crore. In the energy segment, call and put options of CRUDE OIL were traded for Rs.3,34,312.87 crore and call and put options of NATURAL GAS were traded for Rs.1,85,882.61 crore.