MCX records turnover of Rs.11556 crores in Commodity Futures & Rs.91186 crores in Options

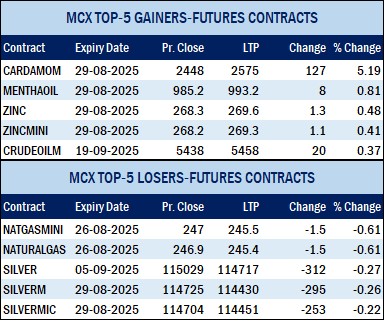

GOLD futures drops by Rs.45 or 0.04% and SILVER futures by Rs.349 or 0.3%, while CRUDEOIL futures gains by Rs.20 or 0.37% : MCXBULLDEX futures reaches at 23403

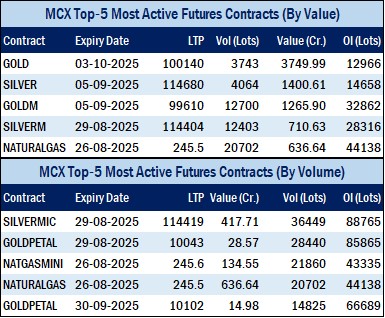

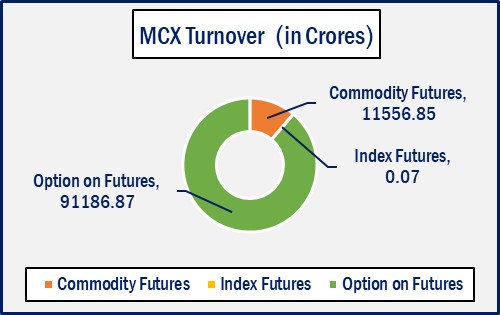

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.102743.79 crores in various futures & option contracts for commodities listed at MCX on Thursday, August 14, 2025 till 4:30 pm. In which commodity futures accounted for Rs. 11556.85 crores and options on commodity futures for Rs. 91186.87 crores (notional). Bullion Index MCXBULLDEX Aug-25 futures was reached at 23403.

Commodity Future Contracts:

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 9169.96 crores. At the time of writing, MCX GOLD futures, with October-2025 expiry contract was down by Rs.45 or 0.04% to Rs. 100140 per 10 gram, GOLDTEN August-2025 contract was down by Rs.52 or 0.05% to Rs. 99725 per 10 gram, GOLDGUINEA August-2025 contract was down by Rs.12 or 0.01% to Rs. 80208 per 8 gram and GOLDPETAL August-2025 contract was down by Rs.2 or 0.02% to Rs. 10043 per gram. On other hand, GOLDM September-2025 contract was down by Rs.46 or 0.05% to Rs. 99610 per 10 gram.

SILVER futures, with September expiry contract was down by Rs.349 or 0.3% to Rs. 114680 per kg, while SILVERM August-2025 contract was down by Rs.321 or 0.28% to Rs. 114404 per kg and SILVERMIC August-2025 contract was down by Rs.285 or 0.25% to Rs. 114419 per kg.

GOLD futures clocked turnover of Rs. 4037.20 crores with volume of 4027 lots and OI of 14223 lots while SILVER futures clocked turnover of Rs. 1685.68 crores with volume of 4880 lots and OI of 18512 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 712.53 crores. COPPER August-2025 contract was down by Rs.0.5 or 0.06% to Rs. 887.6 per kg and ZINC August-2025 contract was up by Rs.1.3 or 0.48% to Rs. 269.6 per kg while ALUMINIUM August-2025 contract was up by Rs.0.5 or 0.2% to Rs. 253.85 per kg and LEAD August-2025 contract was down by Rs.0.15 or 0.08% to Rs. 180 per kg.

COPPER futures clocked turnover of Rs. 425.31 crores, ALUMINIUM futures Rs. 101.93 crores, LEAD futures Rs. 26.32 crores, and ZINC futures clocked turnover of Rs. 121.32 crores.

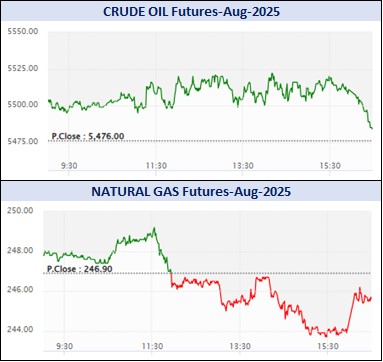

Energy: Turnover of energy futures products contributed for Rs. 1571.76 crores. CRUDEOIL August-2025 contract was up by Rs.20 or 0.37% to Rs. 5496 per BBL while NATURALGAS August-2025 contract was down by Rs.1.4 or 0.57% to Rs. 245.5 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 570.19 crores and NATURAL GAS futures Rs. 763.89 crores.

AGRI: MENTHAOIL August-2025 contract was up by Rs.11.5 or 1.17% to Rs. 997 per kg .

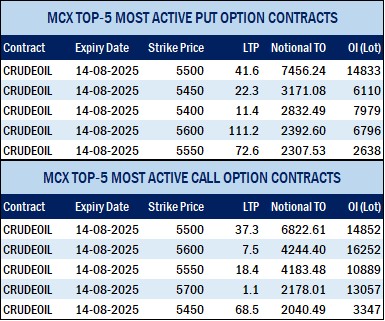

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 91186.87 crores turnover (national), having premium turnover of Rs. 817.14 crores.

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option August contract at Strike price of Rs.5500 was down by Rs.2.8 or 7.04% to Rs. 37.00 with volume of 125479 lots & OI of 15142 lots, while CRUDE OIL Put Option August-2025 contract at Strike price of Rs.5500 was down by Rs.19.2 or 31.12% to Rs. 42.5 with volume of 137763 lots & OI of 14416 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option August contract at Strike price of Rs.250 was down by Rs.0.75 or 8.33% to Rs. 8.25 with volume of 19531 lots & OI of 12590 lots, while NATURAL GAS Put Option August-2025 contract at Strike price of Rs.240 was up by Rs.0.3 or 4.23% to Rs. 7.4 with volume of 18090 lots & OI of 8542 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option August-2025 contract at Strike price of Rs.102000 was down by Rs.37.5 or 6.71% to Rs. 521 with volume of 1743 lots & OI of 932 lots, while GOLD Put Option August-2025 contract at Strike price of Rs.100000 was down by Rs.13 or 1.17% to Rs. 1095 with volume of 2047 lots & OI of 947 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option August contract at Strike price of Rs.115000 was down by Rs.156.5 or 8.25% to Rs. 1741.5 with volume of 1071 lots & OI of 1985 lots, while SILVER Put Option August-2025 contract at Strike price of Rs.115000 was up by Rs.213.5 or 11.45% to Rs. 2078.5 with volume of 855 lots & OI of 512 lots