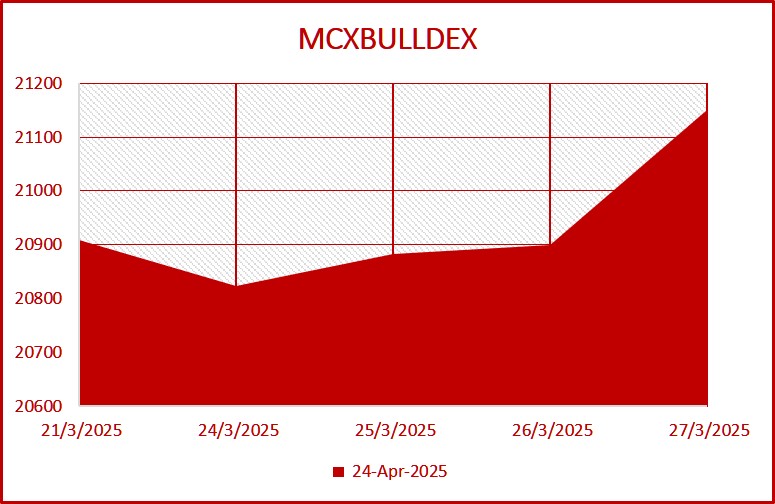

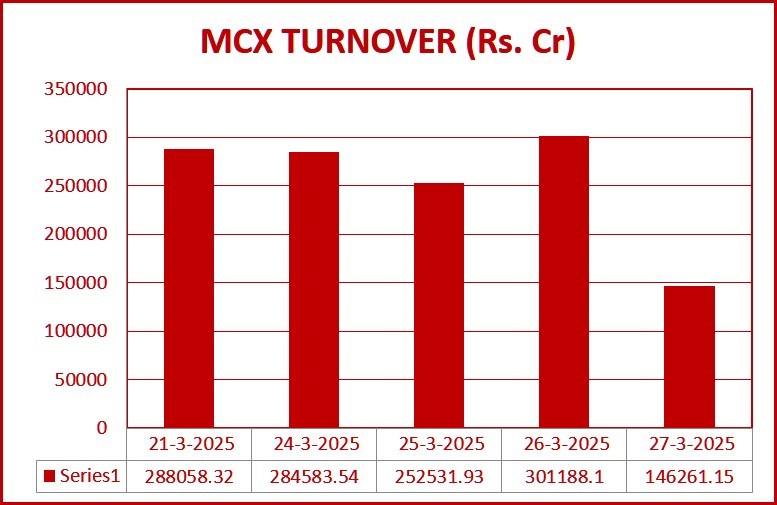

Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs. 12,72,623.05 crores in various futures & option contracts for commodities listed at MCX during the week of March 21 to 27. A movement of 389 points was seen in the April futures of the precious metals index BULLDEX.

In precious metal futures, GOLD and SILVER witnessed a total trading volume of Rs.1,03,919.11 crore in 8,57,184 trades on MCX. In GOLD contracts, MCX GOLD April futures per 10 gram opened the week at Rs.88,431, touched an intra-day high of Rs.88,619 and a low of Rs.87,172 during the week and ended the week at Rs.88,384, down by Rs.322. GOLD-GUINEA April contract per 8 gram declined by Rs.389 to Rs.71,704 and GOLD-PETAL April contract per 1 gram declined by Rs.42 to Rs.9,024. GOLD-MINI April futures opened at Rs.88,450 per 10 gram and closed at Rs.88,213, down by Rs.433.

In SILVER futures, SILVER May futures opened the week at ₹99,000 per 1 kg, touched an intra-day high of ₹1,01,543 and a low of ₹97,147 during the week and closed the week at ₹1,01,313, up by ₹1921. SILVER-MINI April contract rose by ₹1854 to close at ₹1,01,171 and SILVER-MICRO April contract rose by ₹1,848 to close at ₹1,01,161.

In Metals Futures, MCX witnessed a turnover of ₹16,780.08 crore in 1,05,634 trades. ALUMINIUM April futures fell by Rs.9.40 to Rs.251.20 per 1 kg and ZINC April futures fell by Rs.3.25 to Rs.273. COPPER April contract fell by Rs.8.30 to Rs.901.60 and LEAD April contract fell by Rs.1.05 to Rs.182.

Energy segment futures witnessed a total trading volume of Rs.28,358.56 crore in 6,79,607 trades on MCX. CRUDE OIL April futures opened the week at Rs.5,915 and touched an intra-day high of Rs.6,035 and a low of Rs.5,849 during the week and closed the week at Rs.5,995, up Rs.98 per barrel, while NATURAL GAS April futures declined Rs.14.10 to close at Rs.337.90 per 1 MMBTU.

In Agricultural Commodities, MCX witnessed a turnover of Rs.33.03 crore in 630 trades. COTTON CANDY April futures opened at Rs.53,670 per candy and touched an intra-day high of Rs.54,400 and a low of Rs.53,670 during the week and closed the week at Rs.53,900, down Rs.660. MENTHA OIL futures April contract declined by Rs 13.40 per kg to Rs 927.30.

In terms of volume, among precious metals on MCX, GOLD futures traded 80,292.642 kg worth Rs 70,782.98 crore in 2,68,694 trades and SILVER futures traded 3,334.049 tonnes worth Rs 33,136.13 crore in 5,88,490 trades. In the energy segment, CRUDE OIL futures traded 66,95,100 barrels worth Rs 3,978.65 crore in 49,466 trades and NATURAL GAS futures traded 599651250 MMBTU worth Rs 20,265 crore in 3,02,321 trades. In agricultural commodities, 13824 candies of Rs.18.37 crore were traded in 250 trades in COTTON CANDY futures, 158.04 tons of Rs.14.66 crore were traded in 380 trades in MENTHA OIL contracts.

Open interest at the end of the week stood at 23,648.104 kg in GOLD futures and 1,022.548 tons in SILVER futures, 615500 barrels in CRUDE OIL and 14851250 MMBTU in NATURAL GAS and 10944 candies in COTTON CANDY, 87.12 tons in MENTHA OIL.

In index futures, 301 lots of Rs.25.48 crore were traded in 262 trades in BULLDEX futures on MCX during the week. Open interest at the end of the week stood at 101 lots in BULLDEX futures. BULLDEX April futures opened at 21,010, then fell 129 points to 21,150 with a movement of 389 points.

Talking about options, Options on Futures recorded a notional turnover of Rs.11,23,506.79 crore in 66,17,065 trades on MCX. Call and put options of GOLD traded for Rs.5,98,648.19 crore, call and put options of SILVER and SILVER-MINI traded for Rs.28,374.20 crore. In energy segment options, call and put options of CRUDE OIL traded for Rs.2,72,593.34 crore, and call and put options of NATURAL GAS traded for Rs.2,12,594.65 crore.