In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 19343.85 crores. At the time of writing, MCX GOLD futures, with June-2025 expiry contract was up by Rs.1619 or 1.73% to Rs. 95070 per 10 gram, GOLDTEN April-2025 contract was up by Rs.1480 or 1.58% to Rs. 94858 per 10 gram, GOLDGUINEA April-2025 contract was up by Rs.1265 or 1.69% to Rs. 76230 per 8 gram and GOLDPETAL April-2025 contract was up by Rs.163 or 1.74% to Rs. 9532 per gram. On other hand, GOLDM May-2025 contract was up by Rs.1529 or 1.64% to Rs. 94600 per 10 gram.

SILVER futures, with May expiry contract was up by Rs.1657 or 1.75% to Rs. 96431 per kg, while SILVERM April-2025 contract was up by Rs.1616 or 1.7% to Rs. 96401 per kg and SILVERMIC April-2025 contract was up by Rs.1587 or 1.67% to Rs. 96375 per kg.

GOLD futures clocked turnover of Rs. 8524.73 crores with volume of 8982 lots and OI of 24284 lots while SILVER futures clocked turnover of Rs. 4299.06 crores with volume of 14887 lots and OI of 21521 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1909.76 crores. COPPER April-2025 contract was down by Rs.1.25 or 0.15% to Rs. 838.25 per kg and ZINC April-2025 contract was down by Rs.2.65 or 1.06% to Rs. 247.5 per kg while ALUMINIUM April-2025 contract was down by Rs.1 or 0.43% to Rs. 231.25 per kg and LEAD April-2025 contract was down by Rs.0.05 or 0.03% to Rs. 177.5 per kg.

COPPER futures clocked turnover of Rs. 1153.20 crores, ALUMINIUM futures Rs. 186.92 crores, LEAD futures Rs. 23.72 crores, and ZINC futures clocked turnover of Rs. 405.48 crores.

Energy: Turnover of energy futures products contributed for Rs. 1806.84 crores. CRUDEOIL April-2025 contract was up by Rs.39 or 0.74% to Rs. 5305 per BBL while NATURALGAS April-2025 contract was down by Rs.1.9 or 0.67% to Rs. 283.4 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 773.99 crores and NATURAL GAS futures Rs. 775.87 crores.

AGRI: MENTHAOIL April-2025 contract was down by Rs.7.5 or 0.82% to Rs. 911 per kg and COTTONCNDY May-2025 contract was down by Rs.370 or 0.67% to Rs. 54660 per candy.

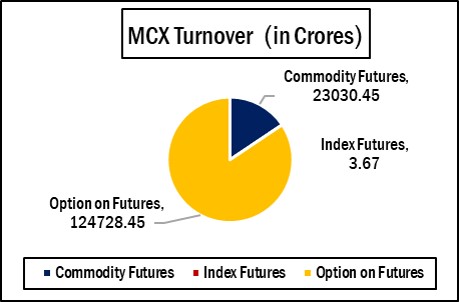

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 124728.45 crores turnover (notional), having premium turnover of Rs. 1199.3 crores.

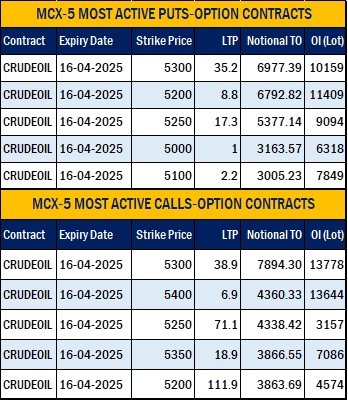

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option April contract at Strike price of Rs.5300 was up by Rs.10 or 34.6% to Rs. 38.90 with volume of 148151 lots & OI of 13778 lots, while CRUDE OIL Put Option April-2025 contract at Strike price of Rs.5300 was down by Rs.26.9 or 43.32% to Rs. 35.2 with volume of 130365 lots & OI of 10159 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option April contract at Strike price of Rs.280 was down by Rs.1.4 or 9.86% to Rs. 12.80 with volume of 22343 lots & OI of 6968 lots, while NATURAL GAS Put Option April-2025 contract at Strike price of Rs.280 was up by Rs.1 or 11.3% to Rs. 9.85 with volume of 25313 lots & OI of 10906 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option April-2025 contract at Strike price of Rs.95000 was up by Rs.715.5 or 102.29% to Rs. 1415 with volume of 2275 lots & OI of 802 lots, while GOLD Put Option April-2025 contract at Strike price of Rs.93000 was down by Rs.466 or 42.36% to Rs. 634 with volume of 2622 lots & OI of 770 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option April contract at Strike price of Rs.95000 was up by Rs.969.5 or 66.15% to Rs. 2435 with volume of 2924 lots & OI of 1149 lots, while SILVER Put Option April-2025 contract at Strike price of Rs.95000 was down by Rs.672 or 40.69% to Rs. 979.5 with volume of 2302 lots & OI of 947 lots.